Questions and answers over funding, and its sources, form part of the latest submissions to the Planning Inspectorate examination of a Development Consent Order application for the Manston airport site.

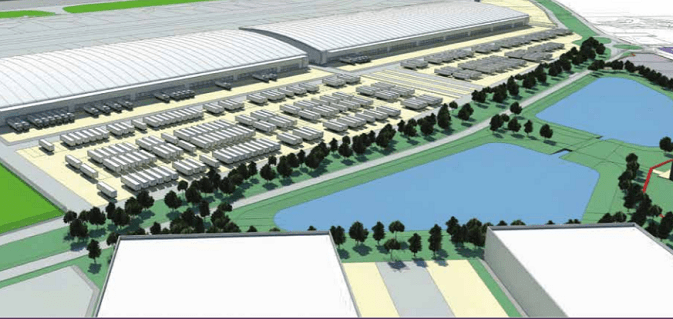

The DCO bid is being made by firm RiverOak Strategic Partners with the aim of acquiring the site and creating a cargo hub and associated aviation business.

However, the land is owned by Stone Hill Park which has submitted a planning application to create up to 3,700 homes, business and leisure and associated infrastructure.

The Planning Inspectorate hearings opened in January and are due to conclude in July.

One of the major questions posed has been how the project, which RSP say will cost in the region of £300 million, will be funded.

Previous concerns centred on the use of funding vehicle M.I.O Investments Limited, which holds 90% of shares in the company but is registered in Belize.

Belize will not disclose its banking or fiscal information to any foreign party and has no reporting requirements.

RSP says it is now restructuring and will ditch the Belize connection. The funding source questions were due to be answered by deadline one, January 18 but RSP said due to the restructure it was unable to provide full information but hoped to do so by deadline 3 (February 15). However, most recent submissions show the restructure is still in process.

SHP: ‘Lack of detail’

In its written submission landowner Stone Hill Park says a lack of financial information exists in the DCO application and casts doubt on whether investors would provide capital for a ‘start-up company’ with no prior airport experience.

The submission says: “The lack of detailed and substantiated financial forecasts, and nothing of substance in relation to how the proposed investment could be commercially financed raises significant questions around the financial viability and fundability of the proposal.

“Commercial lenders and equity providers will expect a track record of EBITDA generation to support funding of the business. A reopened Manston Airport would be a start-up business with a material capital investment requirement and no history of profitability.

“Our experience is that commercial debt and equity providers would be unlikely to provide funding to a reopened Manston Airport on a standalone basis without (i) parent company guarantees (from an entity of sufficient financial standing), and (ii) strong evidence of clear contractual volume and revenue commitments from airline users.

Equity

“A further material issue for the RSP proposal is the much higher threshold of information required to satisfy debt or equity providers for a start-up business with no track record of performance or profitability. This is particularly the case where the project sponsor has no demonstrable track record of developing or operating a commercially successful airport business. This lack of experience and credibility is likely to be a major issue for potential debt and/or equity providers.”

SHP say there would need to be high levels of incentivisation to attract commercial operations but this would have a negative impact for raising external debt or equity. Their submission adds: “For the RSP proposal, the requirement to generate positive cashflow is amplified by the requirement to fund and repay the significant initial investment to reopen the airport, as well as future incremental capital investments.”

RSP: ‘£13 million spend to date’

The funding statement submitted on behalf of RSP lays out predicted costs of the project as £100 million for the first phase -updated to £186 million -, with the cost of developing the remaining phases of the project over a 15-year period estimated to be an additional £200 million, i.e. a total of circa £300 million.

It says compensation for the compulsory take over of the Manston airport site would be “no more than £7.5 million.”

RSP’s latest submission says the firm has spent £13million on the project to date.

However, the identity of investors is yet to be revealed with RSP saying names remain confidential. Their submission adds: “It should be noted that one of the reasons for the confidentiality of the identities of the investors above derives from earlier attempts to secure Manston by CPO via the local authority.

“The applicant previously provided detailed letter-headed correspondence from major global financial investors as to their interest in participating in the Manston project. This correspondence found its way into the public domain to the consternation of the authors who had requested that it be treated as commercially sensitive.”

RSP: Investor descriptions

Investor 1. This institutional investor has a global reach in terms of both the ownership of airport infrastructure, and aviation related assets, namely aircraft leasing, engine manufacturing, and avionics technology development. They are joint venture collaborators with all global air frame manufacturers and are conversant and agreeable with the future requirements of airport capacity in the world’s major population centres, particularly the south east of the UK. This investor has in-house assets both on their own balance sheet, but also on a third party assets under management of in excess of $500 billion.

Investor 2. The applicant has had detailed discussions with a publicly listed global infrastructure institution, which owns and operates a number of major airports in Asia, and has co-invested and participated in numerous financings of airports in the US. This particular investor is keenly interested in expanding its presence into the UK and Europe, and has been involved in the evaluation of our development plans for Manston since very early in the process. This entity has a market capitalization in excess of $150 billion.

Investor 3. This investor is a UK based asset management company with annual revenues of almost £3 billion and responsible for over £400 billion on behalf of its clients This investor has a major mandate to diversify and seek to support investments into the development of UK infrastructure, and Manston fits its criteria. They have been tracking the applicant’s progress both with the DCO application and the details of the scale of proposed development at Manston.

Investor 4. The applicant has had significant ongoing dialogue with this global private family investment entity. This diversified investment vehicle has extensive interests already in airport and strategic infrastructure assets, and again, have been involved in reviewing and advising on our business case and the thesis we have proffered on Manston from very early on in our investment review. This family office has known assets valued in the region of $25 billion.

Investor 5. The applicant has strategic relationships with smaller private groups with extensive specific experience in certain sectors that will have good value to the future success of Manston. These groups have partnered with directors of the applicant previously in other infrastructure investments both in terms of brownfield redevelopment and ground up data centre infrastructure development. One such has executed, in the last three years, the ground up conception, planning approval, construction and delivery, as lead developer, of two major office projects in London with the aggregate value in excess of £700m. One of these projects has since been sold to a major Asian investor for pricing in excess of £330m.

Investor 6. This investor is a global security services group with assets of over £4 billion and annual revenues of £8 billion.” They have expressed a strong interest in participating in the airport project and in investing in fire and security infrastructure.

Experience

RSP disputes that the team have no experience in relation to airport operations, particularly in regard to freight. Their submission says: “Members of the applicant’s team do have extensive experience in relation to the management and operation of freighter cargo, as opposed to belly cargo.

“In particular, the principal of Viscount Aviation was responsible for managing cargo operations at Prestwick Airport prior to the disposal to the Scottish Government, and for Infratil at Manston Airport prior to the sale of the site to Lothian Shelf (718) Limited in 2013.”

RSP says its business plan includes major revenue categories such as cargo handling fees, airside and landside rents, aircraft landing revenues and fuel revenues. Direct costs include personnel handling freight, staffing the control tower, security, fire control, maintenance and passengers operations.

Hearings for the DCO resume on 18, 20, 21 and 22 March.

Coming up: Noise/night flights, jobs and economic impact, freight operation predictions