Thanet council says Ramsgate Development Company Ltd, the owner of the Pleasurama site, has now instructed construction works to begin on the seafront site.

According to a statement from TDC from now until the end of 2017, the company will undertake remedial works to the hoarding and other necessary building preparatory work. The hoarding will remain in place for security. Kent County Council confirmed there is a licence in place for the hoardings with a requirement for them to be maintained.

Approved plans for the Royal Sands site include a 60-bed hotel, 107 residential apartments, leisure facilities, cafés, shops as well as a children’s playground.

The TDC statement says the scheme is expected to employ up to 200 people while under development. Once completed, it is expected to provide long-term jobs in hospitality and retail as well as servicing the residential areas.

The council will be meeting the owners regularly and has assigned a dedicated project officer to monitor performance.

Details of recruitment and which construction firm will be used have not been released. An expected timeline for works has not yet been revealed.

The site has been empty for almost two decades.

Derelict years

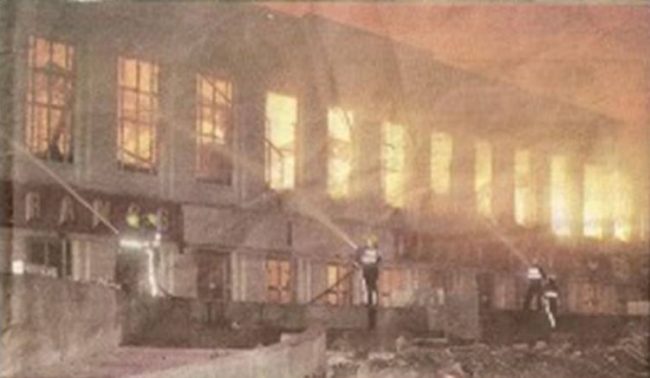

It was destroyed by fire in May 1998, two years after then-owner Jimmy Godden took it over.

Originally planning permission was given to Mr Godden, now deceased, for a shopping centre on the land but, in 2001, when it became clear this was not going to materialise Thanet council bought the site by compulsory purchase.

In 2004 planning permission was granted for a 60-bed hotel, 107 residential apartments, leisure facilities and retail.

The deal was headed by development company SFP Venture UK but work never got underway.

In April 2013, Thanet council rejected a bid for SFP to buy the freehold of the site before project completion.

SFP said it was unable to secure the necessary funds to complete the scheme under the existing development agreement.

In February 2014 cabinet members agreed to axe the development agreement with SFP, but were unable to reclaim the three 199-year leases for the site because they had no long stop date in the deal.

Buy out

Talks with Cardy Construction to take over the project by buying out SFP were revealed in September 2014. A due diligence process was conducted into Cardy Construction Limited the same year. Cardy had to prove it had the funds for the scheme via credit checks, company and company personnel checks; There were also checks on three year audited accounts and evidence was required to show that Cardy Ramsgate Limited purchased 100% shares of SFP Ventures.

Contracts, which TDC say included a long-stop date, were signed with Cardy Ramsgate Ltd – an independent company created for the scheme – in March 2015.

Cardy Ramsgate Ltd completed a £3.515 million payment to Thanet council for the site freehold in July 2016. This amount is listed as £3 million by Land Registry.

Cardy Construction went into administration the same month.

Changing names

Michael Stannard, then the sole director of Cardy Ramsgate Ltd, resigned his role on August 15, 2016.

Mr Stannard had pledged to complete the project by 2017 but his resignation passed the scheme to Anthony Hollis who was appointed as director on August 12, 2016.

The firm was renamed Ramsgate Development Company Ltd.

Mr Hollis is a director of Aldress Developments SE Ltd, formerly SFP Ventures (UK) Ltd until a change of name last year.

Shaun Keegan, one of the founder directors of SFP Ventures with Mr Hollis, resigned his directorship in 2014.

Documents on Companies House reveal two people with ‘significant control’ of the Ramsgate Development Company as Colin and Robbie Hill. Both are listed with an address in Geneva.

They are involved with the Panama-based Mintal Group, which has a £3million charge on the seafront site.

Colin Hill, the son-in-law of Mr Keegan, was also a financier for the previous developers SFP Ventures.

Contract

The contract with TDC stated the project must be completed within three-and-a-half years, which would imply a date of January 2020 if taken from contract completion or 2018 if applied to when the deal was first signed. If it is not developed then the council has an option to buy it back.

It is not clear what sum TDC would need to pay, the £3.5 million the freehold was sold for or the market value of the land which, if developed, could potentially exceed £30-40 million.

The cliff wall adjacent to the building site remains in the ownership of the council, which is responsible for inspections and its maintenance.