A Thanet council budget deficit of £691,000 has been forecast for the 2022/23 financial year, with plans to plug the gap including deleting vacant job roles and a senior management restructure which could save some £100,000.

Proposals will also include an increase in fees and charges by at least 2%, – not including on-street parking charges- and an increase in the Thanet District Council element of residents’ council tax.

The shortfall is less than the £1.8million previously predicted for 2022/23.

Thanet council only gets a small amount of the overall council tax with the rest going to Kent County Council; Kent Police and Crime Commissioner; Kent Fire and Rescue Service and Town/Parish Councils. This means households in a Band D property in Thanet will be paying TDC 68p per day for the services it delivers.

Savings of £573k identified to date include:

- £280k from the removal of vacant staff posts

- £25k from other staffing changes such as agreed reduction in hours

- £57k from contractual savings

- £50k from a reduction in the amount set aside for bad debt

- £30k additional income for bulky waste

- £33k of additional rental income

A £1.17million spend for growth includes:

● £30k for Regeneration

● £402k for Waste Collection

● £85k for Legal

● £400k for Homelessness

● £160k for Your Leisure

There is also predicted to be:

● £50k reduction in income for Building Control

● £50k reduction in income for Licensing.

A report to Cabinet members says another option could be to ask for staff for expressions of interest in voluntary redundancies. A ;service redesign’ is also proposed.

The report says: “After a decade of austerity our services have been subjected to a series of efficiencies and savings reviews and as such there are very few remaining opportunities to implement savings without having an effect on service configuration and consequently our residents, customers or staff. In other words, almost all the ‘easy-wins’ are gone and almost all savings proposals will involve difficult decisions to be made.”

With low reserves and substantial reductions in Government funding, the report cites other financial pressures facing the council. These include: inflation, shortfalls in payments of council tax and business rates, and increases in national insurance contributions. There are also increasing demands on key council services including homelessness and waste and recycling, as more domestic waste is being generated due to home-working and more homes in the district.

The council has also been faced with paying out some £733,000 for legal costs due to on-going disciplinary and grievance proceedings at the authority. Some savings may be made from cases being concluded in actions to be taken following a damning report from auditors.

A further £280,000 has been agreed as settlement following the exit last month of former top officer Tim Willis.

The report sets out three budget scenarios of neutral, positive and pessimistic with shortfalls ranging from £60k to £2million for the financial year.

The report says there are shortfalls in council tax and business rates collections, adding: “The impact of Covid-19 on the council’s council tax income could manifest from the ending of the furlough scheme, and increased unemployment from an economic downturn (resulting in more Council Tax Support (CTS) claimants and non-payment by those not in receipt of CTS).

“Business Rates income could similarly be hit by business failures from an economic downturn. There is also the cliff-edge of the end of Business Rates relief for small businesses and those in retail, leisure and hospitality, with those businesses expected to start paying rates again. It is also highly unlikely that there will be a business grants scheme in 2022-23.”

Cuts to government funding

Thanet council income has been significantly cut since 2010 with huge reductions in Government grants.

The report says: “Over the last decade the council has gone through a series of cost cutting, budget saving and transformation programmes in order to find the reduction in resources needed to balance the budget.

“After more than a decade of austerity, the council received £8m less in government funding in 2021 than we received in 2010, this equates to a 60% cut in funding. Our funding and spending budgets have reduced from £23m in 2010-11 to £17m in 2020-21, a £6m or 26% cash reduction, but after considering the impact of inflation over the period we now have less than half (45%) of the spending power that we had in 2010.”

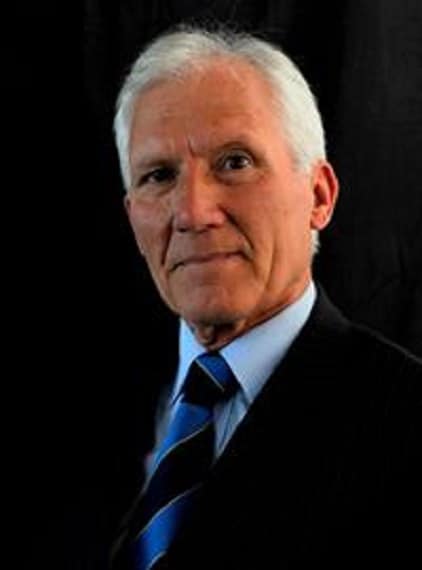

Cllr David Saunders, Cabinet Member for Finance at Thanet District Council, said: “Much like many other local authorities across the country, we are faced with a delicate financial position as we try to plan for the year ahead. At this stage, we must make a number of assumptions to ensure we proactively respond to the financial pressures we are likely to face in the not so distant future.

“These financial pressures, which were evident even prior to the impact of the Covid-19 pandemic, coupled with significant uncertainty surrounding the amount of funding we will receive from central Government, means we are presenting a strategy which very much plans for the worst in a bid to achieve greater financial security for the council further down the line.”

Thanet District Council will discuss its Budget and Medium Term Financial Strategy 2022-26 at a Cabinet meeting on Thursday 18 November.

Once agreed, the Budget and Medium Term Financial Strategy is used to set more specific details around how the council will allocate its future spending. This information is then included in a Budget Report which is published in January for Cabinet approval and then to Full Council the following month (February 2022).

The money that the council uses to fund public services is made up of Council Tax receipts, income generation including from fees and charges, retained Business Rates and any Government funding. Thanet District Council receives just 13p in every £1 of Council Tax.